Taxbuzz | Direct Taxation (Amendment) Bill

With aim to provide fillip to the sluggish economy and promote growth and investment, the Government had by Ordinance made amendments in the Income Tax Act, 1961 (“the Act”) vide the Taxation Laws (Amendment) Ordinance, 2019 (‘the Ordinance’) which was promulgated by the President on 20.09.2019 since the Parliament was not in session. For discussion on the amendments made by virtue of the Ordinance, refer to our TaxBuzz dated 25 September 2019.

The Ordinance is required to be approved by Parliament within six weeks of its reassembly or it ceases to be operative. The Parliament had assembled for the winter session which commenced from 18.11.2019. Hence, the Government, in order to replace/repeal the Ordinance, introduced Taxation Laws (Amendment) Bill, 2019 (‘the Bill’) on 25.11.2019 for approval of the Parliament. The Bill contains certain additions to the amendments made vide the Ordinance, to bring further clarity and certainty to such amendments. The Bill was passed with certain amendments (of a clarificatory nature) by the Lok Sabha on 2 December 2019.

Key features of the additional amendments proposed by virtue of the Bill (as passed by the Lok Sabha) are as under:

Section 115BAA – Lower tax rates introduced for domestic companies

- Under the Ordinance, a new section 115BAA was inserted w.e.f. assessment year 2020-21. It provides that subject to fulfillment of certain conditions, a domestic company can opt to pay income tax at lower rate of 22% (plus applicable surcharge and cess).

For a detailed discussion on the provisions of section 115BAA introduced vide the Ordinance, kindly refer to our TaxBuzz dated 25 September 2019.

The additional amendments proposed under the Bill are as follows: - Where the domestic company violates the provisions of section 115BAA by claiming any impermissible exemptions or deductions, it shall not be eligible to opt for the lower rate of income tax of 22% in the year of default as well as any subsequent year.

- The domestic company opting to be taxed at the lower rate of 22% shall not be entitled to claim MAT credit as per section 115JAA against taxes payable at lower rate.

- As regards non-allowance of unabsorbed depreciation attributable to impermissible deductions, like additional depreciation under section 32(1)(iia) or 32AD, etc., the new amendment provides for corresponding adjustment to the opening written down value of block of assets as on 01.04.2019 in the prescribed manner. In simple words, it appears that the opening WDV would be enhanced by unabsorbed depreciation which remains to be un-allowed owing to opting for the new provisions of section 115BAA of the Act w.e.f AY 2020-21.

- Any carried forward loss or unabsorbed depreciation of an amalgamating company or demerged company, which is attributable to any impermissible exemption or deduction, shall not be permitted to be set off against the income of a domestic company opting to be taxed at a lower rate of 22%

- Under the provisions of section 80LA of the Act, income of a domestic company from a Unit in International Financial Services Centre (‘IFSC’) is eligible for deduction for a period of 10 years. Such deduction shall continue to be available to a domestic company having a unit in IFSC opting to be taxed at a lower rate of 22%

Section 115BAB – Lower tax rates introduced for domestic manufacturing companies

- Under the Ordinance, a new section 115BAB was inserted w.e.f. assessment year 2020-21. It provides that subject to fulfillment of certain prescribed conditions, a new domestic manufacturing company incorporated after 01.10.2019 and commencing manufacturing upto 31.03.2023 can opt to pay tax at a lower rate of 15% (plus applicable surcharge and cess).

For a detailed discussion on the provisions of section 115BAB introduced vide the Ordinance, kindly refer to out TaxBuzz dated 25 September 2019.

The additional amendments proposed under the Bill are as follows: - The following business have been specifically excluded from the scope of the term ‘business of manufacture or production of any article or thing’ for the purposes of charging preferential rate of tax under section 115BAB of the Act:

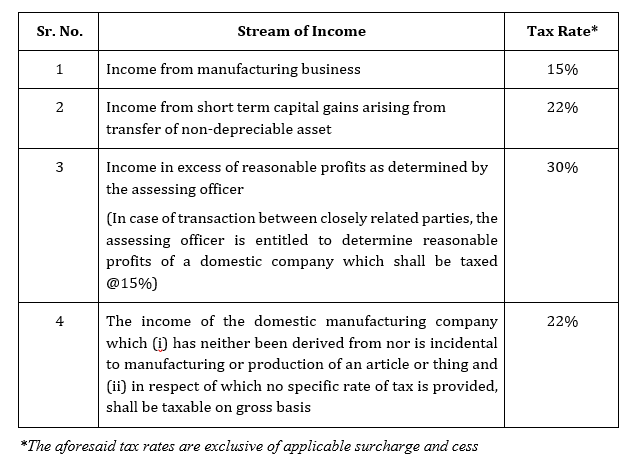

(i) Development of computer software(ii) Mining (iii) Conversion of marble blocks into slabs (iv) Bottling of gas into cylinder (v)Printing of books or production of cinematograph film (vi) Any other business as maybe notified by the Central Government - The tax rates for different streams of income earned by a domestic manufacturing company opting for taxation under section 115BBAB, shall be as follows:

- Akin to the provisions of section 115BAA:

– where the domestic manufacturing company violates the provisions of section 115BAB, it shall not be eligible to opt for the lower rate of income tax of 15% in the year of default as well as any subsequent year.

However, such company has an irrevocable option for applying the provisions of section 115BAA and pay tax at the rate of 22%.

– the domestic manufacturing company is not permitted to claim set off of any carried forward loss or unabsorbed depreciation of an amalgamated or demerged company– the domestic company shall not be entitled to claim MAT credit against taxes payable at lower rate.

- The CBDT has been empowered to issue guidelines under section 115BAB for the purpose of removing any difficulties faced by domestic manufacturing company for complying with the conditions pertaining to use of new plant and machinery or where it is engaged in business other than business of manufacture or production. These powers to issue guidelines have been granted with a view to promote manufacturing by using new plant and machinery.

Other provisions

The amendments with respect to (i) section 115JB to reduce MAT to 15% as well as non-applicability of MAT to companies opting for lower rate of taxation; (ii) section 115QA to exclude transaction of buy-back of listed shares announced on or before 5th July, 2019 (iii) rationalization of surcharge provisions, have been covered in our TaxBuzz dated 25 September 2019.

Observations/ Comments with respect to the additional amendments:

- Under the new / amended provisions of section 115BAB, it appears that short term capital gains arising on sale of listed shares of company opting taxation under that section would be taxable at the rate of 22%, while the rate of tax applicable to other investors as per section 111A would be 15%. Hence, the provision leads to increased tax burden for a domestic manufacturing company opting for lower rate of taxation.

- The Bill provides clarity with respect to non-availability of MAT credit to companies opting for lower rate of taxation, which was a subject matter of debate prior to the amendment.

- The proposal of enhancement of WDV qua unabsorbed depreciation which remains to be un-allowed owing to opting for the new provisions of section 115BAA of the Act w.e.f AY 2020-21 is also a welcome change in the direction of bringing in clarity and further relief for transition.

- The taxation of other income (income other than derived from manufacturing business) of company opting under section 115BAB @ 22% on gross basis (without allowance of deduction/loss) and short term capital gains on listed securities @22% is burdensome, which could be an important factor dissuading companies to opt the new scheme.

- Empowering the CBDT to issue guidelines to minimize the hardships faced by domestic companies to comply with the provisions of section 115BAB is a welcome step.

For any details and clarifications, please feel free to write to:

Mr. Gaurav Jain at [email protected]

Mr. Deepesh Jain at [email protected]

Mr. Kunal Gokhale at [email protected]