Between the Lines | Supreme Court: Guarantor is barred from being a resolution applicant under Section 29A(h) of the Insolvency and Bankruptcy Code, 2016 if guarantee has been invoked by any creditor, not necessarily being the creditor initiating the insolvency proceedings

The Hon’ble Supreme Court (“SC”) has in its judgment dated January 18, 2022 (“Judgement”) in the matter of Bank of Baroda and Another v MBL Infrastructures Limited and Others [Civil Appeal No. 8411 of 2019] held that once a personal guarantee is invoked by any creditor, notwithstanding the fact that the application initiating the corporate insolvency resolution process (“CIRP”) was filed by another creditor, such guarantor stands ineligible to submit a resolution plan under Section 29A(h) of the Insolvency and Bankruptcy Code, 2016 (“IBC”).

Facts

The instant case throws light on the judicial interpretation of Section 29A(h) of the IBC. M/s. MBL Infrastructures Limited (“Respondent No. 1”) was set up by Mr. Anjanee Kumar Lakhotiya (“Respondent No. 3”). Loans/ credit facilities were obtained by the Respondent No. 1 from a consortium of banks. On the failure of the Respondent No. 1 to act in tune with the terms of repayment, some of the respondents were forced to invoke the personal guarantees extended by the Respondent No. 3 for the credit facilities availed by the Respondent No. 1. M/s. RBL Bank and M/s. State Bank of Bikaner and Jaipur issued a notice under Section 13(2) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (“SARFAESI”), after duly invoking the personal guarantee of the Respondent No. 3. Thereafter, M/s. RBL Bank filed an application under Section 7 (Initiation of CIRP by financial creditor) of the IBC before the National Company Law Tribunal, Kolkata (“NCLT”) to initiate CIRP against Respondent No. 1, which was admitted.

Two resolution plans were received by the resolution professional (“Respondent No. 2/RP”), of which, one was authored by Respondent No. 3 on June 29, 2017 (“Plan”). Thereafter, by way of the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2017, Section 29A (Persons not eligible to be resolution applicant) was introduced to the IBC. At the instance of the Committee of Creditors (“CoC”), the Respondent No. 3 submitted a modified Plan. The CoC held its meeting on December 1, 2017 to deliberate upon the impact of the aforesaid amendment qua the eligibility of the Respondent No. 3 in submitting the Plan in the CIRP proceedings. In view of the lingering doubt expressed, the Respondent No. 3 filed an application praying for a declaration that he was not disqualified from submitting the Plan under Section 29A(c) and Section 29A(h) of the IBC.

The NCLT, by its order dated December 18, 2017 (“2017 Order”) held that the Respondent No. 3 was eligible to submit a resolution plan, notwithstanding the fact that he had extended his personal guarantees on behalf of the Respondent No. 1, which were duly invoked by some of the creditors. This issue was never placed and raised before the NCLT. The NCLT ruled that inasmuch as the personal guarantee having not been invoked and the Respondent No. 3 merely having extended his personal guarantee, as such there is no disqualification per se under Section 29A(h) of the IBC, as the liability under a guarantee arises only upon its invocation. As debt payable by Respondent No. 3 was not crystalized, he could not be construed as a defaulter for breach of the guarantee. With such clarification, the application filed was allowed by taking into consideration the amendment introducing Section 29A of the IBC.

Aggrieved by the 2017 Order, Punjab National Bank (“Respondent No. 10”) appealed to the National Company Law Appellate Tribunal (“NCLAT”), which passed an interim order facilitating the RP and CoC to go through with the Plan, but prohibiting the NCLT to accept the same, without prior approval of the NCLAT. Respondent No. 1, Respondent No. 2, Respondent No. 3 and Respondent No. 10 are collectively referred to as “Respondents”. The Plan was put to vote and received 68.50% vote share of the CoC. The extended 270 day period of CIRP expired on December 25, 2017. Subsequently, RBL Bank also filed an appeal against the NCLT order to the NCLAT. With the approval of Indian Overseas Bank, the Plan gathered 78.50% vote share. Section 29A(h) was further amended post which it read, “has executed an enforceable guarantee in favour of a creditor, in respect of a corporate debtor against which an application for insolvency resolution made by such creditor has been admitted under this code“. On March 23, 2018, the NCLAT allowed RBL Bank and Respondent No. 10 to withdraw their respective appeals in view of the Plan having reached the mandatory requirement of 75% as warranted under Section 30(4) of the IBC, making it clear that they did not have any grievance with the CoC decision. However, a request made by Bank of Baroda (“Appellant”) before the NCLAT seeking to be impleaded as a party to continue the lis was not considered favourably without assigning any reasons.

Thereafter, the NCLT approved the Plan by its order dated April 18, 2018 (“NCLT Order”), owing to the fact that the issue qua the eligibility under Section 29A(h) of the IBC had been decided, coupled with the Plan crossing the requisite threshold of approval by the CoC, that is, 75% vote share. A subsequent appeal was made before the NCLAT by the Appellant, which confirmed the order of the NCLT (“NCLAT Order”). Aggrieved, the Appellant filed an appeal before the SC.

Issue

Whether Respondent No. 3 being the guarantor was ineligible under Section 29A(h) of the IBC to submit the Plan.

Arguments

Contentions raised by the Appellant:

The Appellant submitted that Section 29A of the IBC had to be given a holistic interpretation as the objective was to weed out undesirable persons with the intention of promoting primacy of debt, by disqualifying guarantors who had not fulfilled their co-extensive liability with the insolvent corporate debtor. It was argued that Respondent No. 3 was ineligible to submit the Plan under Section 29A(h) of the IBC, as several personal guarantees executed by the Respondent No. 3 in favour of various creditors of the Respondent No.1 stood invoked, prior to commencement of CIRP, which was suppressed by Respondent No. 2 and Respondent No. 3 before the NCLT. Therefore, the premise on which the NCLT held the Respondent No. 3 eligible to submit the Plan was ex facie false. Further, it was argued that the law which was prevailing on the date of the application had to be seen, therefore, the disqualification would be attracted on the date of filing of the application.

Lastly, it was submitted that a legal ineligibility could not be done away with by alleged estoppel and such ineligibility had to be considered by courts irrespective of any waiver by any party or creditor. It was pointed out that the approval of the Plan was made after the expiry of the CIRP period. It was submitted that owing to the clear infraction of Section 12 (Time limit for completion of insolvency resolution process) of the IBC, the orders passed should be set aside.

Contentions raised by the Respondents:

The Respondents averred that a decision made by the CoC in its commercial wisdom on being satisfied with the viability and feasibility of the resolution plan, should not be interfered with by the SC. Calling the revised plan accepted by the NCLAT an improvement to the earlier one, it was submitted that the Appellant being aware of the decision of the NCLT in the first instance, ought to have taken it further. Further, it was contended that the Appellant was estopped from questioning the eligibility of Respondent No. 3.

It was further argued that Section 29A(h) of the IBC had to be literally interpreted to the extent that a personal guarantor is barred from submitting a resolution plan only when the creditor invoking the jurisdiction of the NCLT has invoked a personal guarantee executed in favour of the said creditor by the resolution applicant. It was pointed out that no personal guarantee stood invoked by RBL Bank at the time of application to the NCLT under Section 7 of the IBC. It was further submitted that the invocation of the consortium guarantee by Allahabad Bank and State Bank of Bikaner and Jaipur under Section 13(2) of the SARFAESI was ex facie illegal in terms of the inter-se agreement executed between the members of the consortium of banks.

It was also contended that the object of the IBC is the revival of the corporate debtor, liquidation being the last resort, and any interference would have an adverse effect and militate against the very object of the IBC. The Respondents highlighted that after the approval of the Plan, several projects of national importance had been completed and various others were under execution. Further, all workmen had also been paid in full, and all current employees, operational creditors and statutory dues were being regularly paid.

Observations of the Supreme Court

The SC noted that the idea of the IBC is to facilitate a process of rehabilitation and revival of the corporate debtor with the active participation of the creditors, and that there are only two principal actors in the entire process, that is, the CoC and the corporate debtor.

The SC noted that the objective behind Section 29A of the IBC is to avoid unwarranted and unscrupulous elements to get into the resolution process while preventing their personal interests to step in and prevent certain categories of persons not in a position to lend credence to the resolution process by virtue of their disqualification. Explaining the scope of Section 29A(h) of the IBC, the SC opined that once a person executes a guarantee in favour of a creditor with respect to the credit facilities availed by a corporate debtor, and in a case where an application for insolvency resolution has been admitted, with the further fact of the said guarantee having been invoked, the bar qua eligibility would certainly come into play. The provision requires a guarantee in favour of ‘a creditor’. Once an application for insolvency resolution is admitted on behalf of ‘a creditor’, then the process would be one of rem, and therefore, all creditors of the same class would have their respective rights at par with each other.

While interpreting Section 29A(h), the SC noted that the word “such creditor” in Section 29A(h) of the IBC meant similarly placed creditors after the application for insolvency application is admitted by the adjudicating authority. The SC observed that to earn a disqualification under Section 29A(h) of the IBC, there must be a mere existence of a personal guarantee that stands invoked by a single creditor, notwithstanding the application being filed by any other creditor seeking initiation of insolvency resolution process. This is subject to further compliance of invocation of the said personal guarantee by any other creditor. Any other interpretation would lead to an absurdity striking at the very objective of Section 29A of the IBC, and in turn the IBC. Ineligibility has to be seen from the point of view of the resolution process and it can never be said that there can be ineligibility qua one creditor as against others.

The SC observed that if there is a bar at the time of submission of resolution plan by a resolution applicant, it is obviously not maintainable. However, if the submission of the plan is maintainable at the time at which it is filed, and thereafter, by the operation of the law, a person becomes ineligible, which continues either till the time of approval by the CoC, or adjudication by the authority, then the subsequent amended provision would govern the question of eligibility of resolution applicant to submit a resolution plan. The resolution applicant has no role except to facilitate the process. If there is ineligibility which in turn prohibits the other stakeholders to proceed further and the amendment being in the nature of providing a better process, and that too in the interest of the creditors and the debtor, the same is required to be followed as against the provision that stood at an earlier point of time. Thus, a mere filing of the submission of a resolution plan has got no rationale, as it does not create any right in favour of a facilitator nor can it be extinguished.

Factually, in the instant case, it was noted that Respondent No. 3 had executed personal guarantees which were invoked by three of the financial creditors even prior to the application filed, thereby attracting Section 29A(h) of the IBC. Thus, in the touchstone of the interpretation of Section 29A(h) of the IBC by the SC, it was held that the plan submitted by the Respondent No.3 ought not to have been entertained. The SC also agreed with the NCLT that Section 12 of the IBC would not get attracted on account of pending proceedings with interim orders.

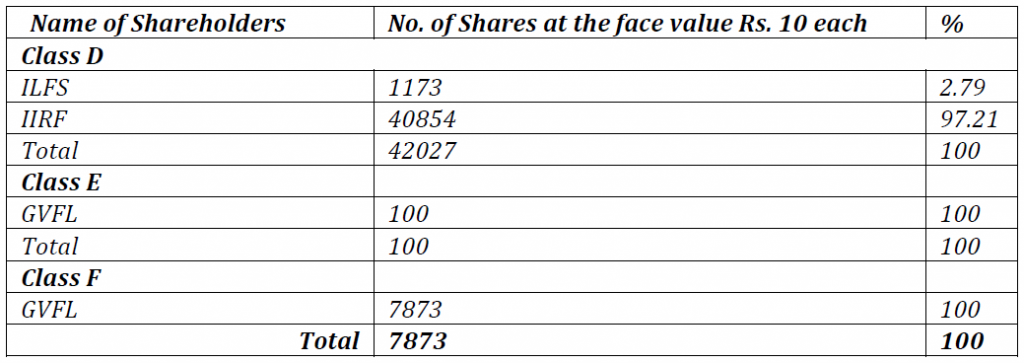

The SC observed that the majority of the creditors had given their approval to the Plan. The SC agreed with the observation of the NCLT that the Plan was accordingly approved after taking into consideration, the techno-economic report pertaining to the viability and feasibility of the Plan. Moreover, it was observed that the Plan became operational since April 18, 2018, and the Respondent No. 1 was an on-going concern. Taking note of the interest of over 23,000 shareholders and thousands of employees of the Respondent No. 1, and of the ongoing projects of the Respondent No. 1 of public interest, it observed that the ultimate object of the IBC, was to put the corporate debtor back on the rails and no prejudice would be caused to the dissenting creditors as their interests would otherwise be secured by the Plan itself. Hence, the SC wished not to interfere with the Plan.

Decision of the Supreme Court

The SC held that the plan submitted by the Respondent No. 3 ought not to have been entertained. The SC held that the NCLT and the NCLAT were not right in rejecting the contentions of the Appellant on the ground that the earlier appeals having been withdrawn without liberty, the issue qua eligibility cannot be raised for the second time. It held that since the Appellant was not a party to the decision of the NCLT on the first occasion, in the appeal the Appellant merely filed an application for impleadment, and so the principle governing res judicata and issue estoppel would not get attracted. Thus, it was held that the reasoning rendered by the NCLAT to that extent cannot be sustained in law. However, noting the peculiar facts of the instant case the SC dismissed the appeal so as to not disturb the Plan leading to the on-going operation of the Respondent No. 1.

VA View:

Through this Judgement, the SC has in accordance with the objective of IBC, given prime importance to the revival of the corporate debtor and its working as a going concern. While the SC accepted that the orders passed by the NCLT and NCLAT were flawed, considering the commercial wisdom of the CoC and the possible adverse impact the revocation of the Plan might have on the corporate debtor, the SC, following the spirit of the IBC, did not set aside the Plan.However, for similar cases that may arise in the future, the SC has categorically laid down that invocation of personal guarantee by any single creditor, irrespective of the fact that an application initiating CIRP has been made by another creditor, suffices to disqualify the guarantor from submitting a resolution plan.

Thus, the SC through this Judgement has struck a fine balance between clarifying the law on Section 29(A)(h) of the IBC, while also ensuring that the corporate debtor is brought back on its feet, without once again getting embroiled in the process of IBC.

For more information please write to Mr. Bomi Daruwala at [email protected]