- More

- Back

- About us

- Practice Areas

- Publications

- CSR

- Firm Policy

- Firm Policy

- POSH Policy

- Contact us

Between the Lines | NCLT: The shareholders are different from lenders January 19, 2022

Published in: Between The Lines

DISCLAIMER: The material contained in this publication is solely for information and general guidance and not for advertising or soliciting. The information provided does not constitute professional advice that may be required before acting on any matter. While every care has been taken in the preparation of this publication to ensure its accuracy, Vaish Associates Advocates neither assumes responsibility for any errors, which despite all precautions, may be found herein nor accepts any liability, and disclaims all responsibility, for any kind of loss or damage of any kind arising on account of anyone acting/ refraining to act by placing reliance upon the information contained in this publication.

The National Company Law Tribunal, Mumbai (“NCLT”) has in its judgment dated November 29, 2021 (“Judgement”), in the matter of Hubtown Limited v. GVFL Trustee Company Private Limited [M.A. 2411/2019 IN C.P. 4128/I&B/MB/2018 and others], held that shareholders are different from lenders.

Facts

Hubtown Limited (“Corporate Debtor”) was earlier known as Ackruti City Limited. The Corporate Debtor was a shareholder in a company called Hubtown Bus Terminal (Mehsana) Private Limited (“HBT Mehsana”), which was a special purpose vehicle incorporated to, inter alia, undertake and complete reconstruction and development of commercial and residential property at Mehsana, Gujarat by the Corporate Debtor. GVFL Trustee Company Private Limited (“GVFL”) filed a petition under Section 7 of the Insolvency and Bankruptcy Code, 2016 (“IBC”) against the Corporate Debtor for a debt by way of equity investment in shares of HBT Mehsana for a total amount of Rs.4,30,54,200/- as principal and Rs.9,96,95,800/- as Internal Rate of Return (“IRR”) calculated at 26% of the principal up to August 31, 2018.

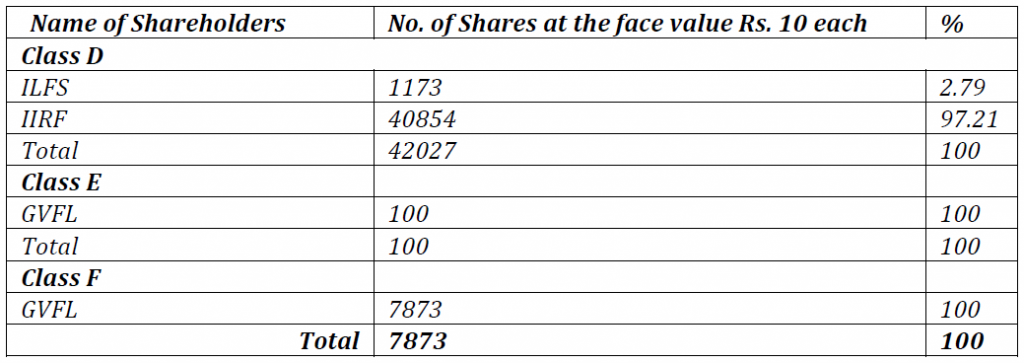

Earlier, a Share Subscription and Shareholders Agreement dated September 24, 2010 (“SHA”) was signed between IL&FS Trust Company Limited (“ILFS”), IIRF India Realty XVIII Limited (“IIRF”) and the Corporate Debtor and two other promoters of HBT Mehsana. Consequent to the SHA, IL&FS and IIRF invested in HBT Mehsana by subscribing to Class ‘A’ equity shares, Class ‘B’ equity shares and Class ‘D’ equity shares. On May 29, 2013 a Share Purchase Agreement (“SPA”) was executed between GVFL, the ILFS group, the Corporate Debtor and two other promoters of HBT Mehsana. In terms of this SPA, GVFL purchased the shares (Class ‘D’ shares) of HBT Mehsana from the ILFS group for a total amount of Rs.4,30,54,200/-. These shares were reclassified as Class ‘E’ and Class ‘F’ equity shares as under.

Under the SHA, GVFL was provided with shareholders’ rights like right to nominate one director on the board of HBT Mehsana, right to vote in annual general meeting (“AGM”)/ extraordinary general meeting (“EGM”), special veto power, etc. Other shareholders’ right which accrued to GVFL included giving various exit options under the SHA which has been enumerated at Clause 13.1 of the SHA, which reads as under:

“13.1. The Investor No.3 shall have the following rights which the Investor No.3 shall be free to exercise at any time in the manner specified in the said clauses:

13.2. Annual Put Option;

13.3. Listing;

13.4. Buy-back of all shares held by the Investors No.3 in the Company;

13.5 Accelerated Put; and

16 – Strategic Sale and Withholding of Sale of Project Assets.”

The NCLT noted that these options are part of a shareholder’s right. The claim of GVFL was that the payments by GVFL were made to purchase shareholding in HBT Mehsana. GVFL had sought to exercise its right under the “put option” for the first time in December 2013 and the said Section 7 petition under the IBC was filed by them in November 2018 purportedly for a debt amount of Rs. 4,30,54,200/- along with return calculated at IRR of 26% till August 31, 2018.

There were three other projects for which three more special purpose vehicle companies were separately incorporated by the Corporate Debtor and were a subject matter of CP No. CP(IB)-4128/2018 (HBT Vadodara), CP No. CP(IB)-4130/2018 (HBT Ahmedabad) and CP No. CP(IB)-4131/2018 (HBT Adajan) filed under Section 7 of the IBC (“Other Company Petitions”). For these Other Company Petitions, miscellaneous applications had been filed by the Corporate Debtor challenging their maintainability. The NCLT noted that, the outcome of the instant maintainability application in the said case will also be applicable to other aforementioned miscellaneous applications filed under Other Company Petitions.

Issue

Whether shareholders are lenders, that is, whether GVFL is a financial creditor and, thus, whether the debt claimed is a financial debt.

Arguments

Contentions raised by GVFL:

GVFL contended that, the Corporate Debtor had defaulted as required for admission of a petition under Section 7 of the IBC, as its “put option” was not entertained when the demand notice dated January 02, 2018 was sent to the Corporate Debtor demanding exit by way of “put option”.

Observations of the NCLT

The NCLT noted that, it had to analyze whether the claim of GVFL as a shareholder of HBT Mehsana in exercise of its ‘put option’ tantamounts to a financial debt. The NCLT noted the relevant definitions under the IBC to analyse the said issue were of the “financial creditor” and “financial debt”. The NCLT noted that the IBC defines financial creditor under Section 5(7) of the IBC to mean any person to whom a financial debt is owed and includes a person to whom such debt has been legally assigned or transferred to. The NCLT further noted that, financial debt as defined under Section 5(8) of the IBC meant a debt along with interest, if any, which is disbursed against the consideration for the time value of money.

The NCLT further noted that as per the SHA, GVFL invested in HBT Mehsana by purchasing the shares of ILFS group and, therefore, observed that, this cannot be termed as an investment of GVFL by way of a loan. The money paid by GVFL to acquire the shares of HBT Mehsana cannot be construed as a consideration for time value of money and it was solely for the purchase of shares of HBT Mehsana held by ILFS group to become a shareholder in the said company.

The NCLT also noted that the SPA and SHA are both contracts in relation to GVFL’s acquisition of equity shareholding in HBT Mehsana. Further, as per the SHA, GVFL had acquired various rights as mentioned above. It was abundantly clear to NCLT that no voting rights ever accrue to a “Financial Creditor” under the IBC in any AGM/ EGM. Therefore, the rights enjoyed by GVFL in HBT Mehsana, like exercising votes in the AGM/ EGM, are typically the rights of a shareholder and not a “Financial Creditor” since equity is not a debt.

The NCLT was of the view that the SPA entered into for the share purchase in HBT Mehsana by GVFL, with exit option of, inter alia, “Annual Put Option”, cannot be considered as a debt which is disbursed against consideration of time value for money. The NCLT also noted that IRR cannot be equated with interest payments.

The NCLT was of the view that GVFL may be entitled to this claim under the SHA as a shareholder of HBT Mehsana, however, the NCLT had no doubt that the claim of GVFL cannot be termed as a “Financial Debt” as contemplated under the IBC. The NCLT observed that a shareholder is different from a lender.

Decision of the NCLT

Therefore, the NCLT allowed the miscellaneous application challenging the maintainability of the petition filed under Section 7 of the IBC. As a corollary, the NCLT dismissed the Section 7 application stating the same to not be maintainable as per the provisions of the IBC. Similarly, based on the above observations, other miscellaneous applications as mentioned above regarding maintainability of Other Company Petitions were also allowed and as a corollary, the Other Company Petitions were dismissed as not maintainable.

VA View:

The NCLT in this Judgement was of the view that a shareholder is different from a lender. The NCLT correctly observed that, any contract for acquisition of shareholding in a body corporate can never result in the formation of a debt. The NCLT was of the view that the SPA entered into for the share purchase in HBT Mehsana by GVFL with exit option of, inter alia, “Annual Put Option”, cannot be considered as a debt which is disbursed against consideration of time value for money.

The said observation of NCLT was deduced by analysing the fact that, a shareholder undertakes the risk by investing in shares and derives its return by way of profits in the form of dividends and appreciation in the value of shareholding, that is, capital gains. However, in contrast, a lender gives loans for which the profit is earned on repayment made along with Interest. It was also clarified that, the relevance of IRR for an investor in shares is in relation to expected profit and dividend payout and capital appreciation of the shares, which is totally different from the interest which is return for any investment by way of loan.

For more information please write to Mr. Bomi Daruwala at [email protected]

DOWNLOAD NEWSLETTER