GST Cafe – Take a look at the Highlights of the 37th GST Council Meeting September 24, 2019

Published in: GST Cafe

Disclaimer: While every care has been taken in the preparation of this GST Cafe to ensure its accuracy at the time of publication, Vaish Associates Advocates assumes no responsibility for any errors which despite all precautions, may be found therein. Neither this bulletin nor the information contained herein constitutes a contract or will form the basis of a contract. The material contained in this document does not constitute / substitute professional advice that may be required before acting on any matter. All logos and trademarks appearing in the newsletter are property of their respective owners.

The following are the highlights of the 37th GST Council meeting held on September 20, 2019 along with notifications implementing decisions taken during the meeting.

Law and Procedure related changes

- Requirement for filing of Annual Return for F.Y. 2017-18 & 2018-19 waived for composition taxpayers

- Requirement for filing of Annual Return for F.Y. 2017-18 & 2018-19 made optional for taxpayers with annual turnover of up to Rs. 2 crore

- Restrictions to be imposed on recipients w.r.t. availment of ITC, in case details of outward supplies not provided under Form GSTR-1. This proposal, in our view, is in violation of Sec. 16 of CGST Act, which entitles assessee to claim ITC if vendor has deposited tax with Govt. The law does not entail furnishing of GSTR-1 by vendor for claim of ITC by recipient. With new return system being implemented from April 2020, such amendment will pose operational challenge for taxpayers in the transitional phase

- New returns system proposed to be introduced from April, 2020 (earlier proposed from 01.10.2019)

- Integrated refund system with disbursal by single authority proposed to be introduced from 24.09.2019

- End date for filing appeal against orders of Appellate Authority before GST Appellate Tribunal extended

- Circular to be issued clarifying procedure for claiming refund subsequent to favorable order in appeal or any other forum

- Circular clarifying taxability w.r.t. supply of ITES services being made on own account or as intermediary to be issued, in supersession of earlier circular dt. 18.07.2019

- Circular dt. 28.06.2019, issued with respect of post-sales discount withdrawn ab-initio

- Exemption from payment of GST on export freight by air or sea extended up to 30.09.2020

In Principle Approval

- Aadhar number to be linked with GST registration of taxpayers and such linking proposed to be made mandatory for claiming refund

- In order to tackle menace of fake invoices and fraudulent refunds, in principle decision to prescribe reasonable restrictions on passing of credit by risky taxpayers including risky new taxpayers

Rate Changes on services (w.e.f. 01.10.2019) [Notif. No. 20/2019-CT (R)]

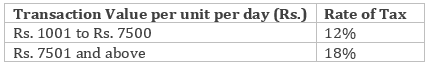

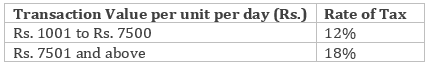

- Tax on hotel accommodation services reduced as under:

- Tax on outdoor catering services (other than in premises with accommodation of daily tariff of Rs. 7501 or above per unit) reduced to 5% without ITC from present 18% with ITC

- Special Procedure for payment of tax rescinded w.r.t. development rights supplied on or after 01.04.2019 [Notif. No. 23/2019-CT(R)]

- Grant of alcoholic liquor license neither a supply of goods nor a supply of service. [Notif. No. 25/2019-CT(R)]

- Manufactures of aerated water excluded from purview of the composition scheme w.e.f. 01.10.2019 [Notif. No. 43.2019-CT]

- Refund of compensation cess disallowed for tobacco and manufactured tobacco substitutes in case of inverted duty structure [Notif. No.3/2019-CC(R)]

- Changes in rates of compensation cess [Notif. No. 2/2019-CC(R)]